Make 2014 more profitable by upgrading to brand-new EEG equipment before December 31st and using the available section 179 deduction.

Neurovirtual encourages businesses to take advantage of the Section 179 tax deduction to add needed new equipment now and potentially lower your tax payment to the government, freeing up cash for your other business needs and lowering the true cost of the equipment by thousands of dollars.

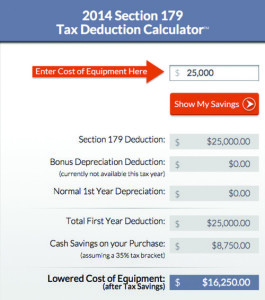

So how does it work? Our partners at section179.org provide an example using the $25,000 max allowable deduction.

A $25,000 purchase carries a true cost of $16,250. That’s $8,750 added to your bottom line.That’s an extra nearly 9 grand that stays in your business.

We invite you click here to calculate how much you could save on your new equipment if you act now. Many businesses find that, if they finance their Section 179 qualified equipment, the tax savings actually exceed the first year’s payments on the equipment!

*The information contained within this publication is borrowed from section179.org and provided for informational purposes only. It is not intended to substitute for obtaining accounting, tax, or financial advice from a tax professional or financial planner.